In an era defined by mobility, the traditional model of wealth management is being fundamentally disrupted. Ultra-high-net-worth individuals (UHNWIs) no longer tether their lives to a single geography, yet their wealth still sits in multiple, legacy systems around the world. This paradox, where owners move but assets don’t, has profound implications for visibility, control, and strategic decision-making across an increasingly global portfolio.

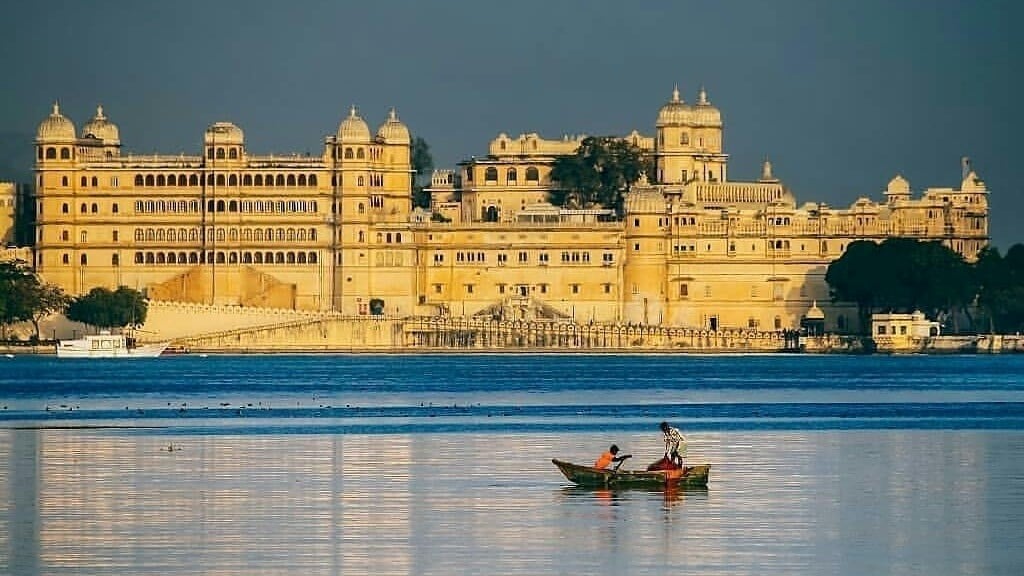

The Age of Wealth Without Borders

Until recently, wealth relocation followed a straightforward logic: you moved, and your assets moved with you. Residency in Geneva would often lead to a consolidation of banking relationships there; relocating to Monaco meant shifting financial and legal structures accordingly. Geography defined custody.

That paradigm no longer applies. Today’s UHNWIs accumulate wealth in specific jurisdictions for their own reasons, trust in longtime custodians, tailored legal advantages, or deep local expertise, while choosing to physically live elsewhere. A principal might hold Swiss-based portfolios, maintain property interests in London, and conduct tax planning from Dubai, all while residing in Singapore.This shift isn’t accidental, it reflects a more sophisticated approach to wealth management where diversification isn’t just financial but jurisdictional.

Complexity Breeds Visibility Challenges

With wealth dispersed globally, complexity multiplies rapidly. Each jurisdiction brings its own reporting standards, regulatory requirements, currency risks, and advisor ecosystems. Instead of working with a small circle of advisors in one place, today’s mobile UHNWIs often coordinate with multiple specialists, bankers, tax strategists, estate planners, each operating under different standards and timelines.

According to Capgemini’s latest World Wealth Report, the average number of wealth management relationships for UHNWIs has risen from three to seven in just a few years often across different continents.This proliferation of relationships creates information silos rather than a unified view of wealth. Quarterly reports from Zurich arrive on one schedule; property valuations from London arrive on another. Reconciling these into a coherent picture is not only time-consuming but increasingly impossible using spreadsheets and email alone.

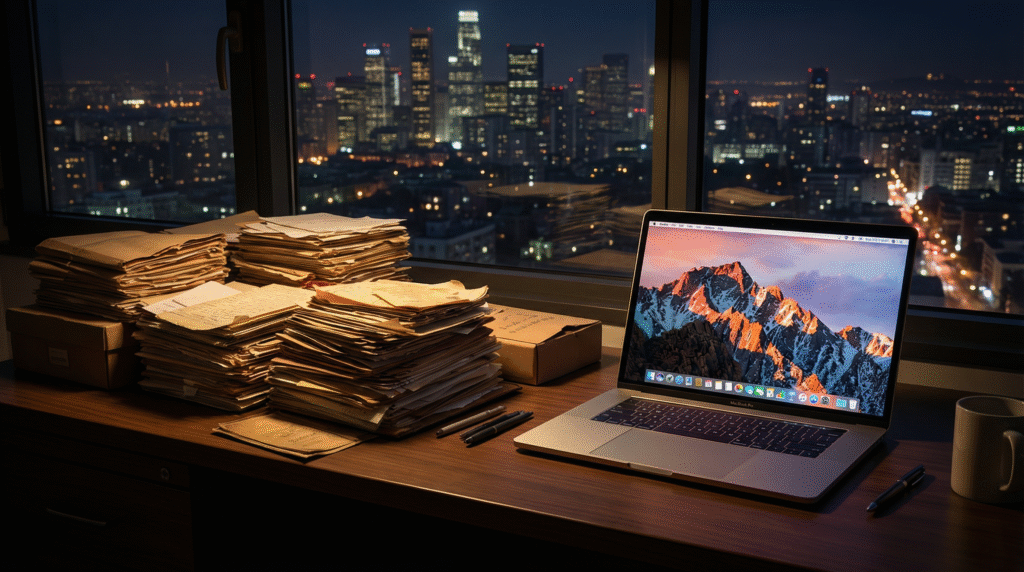

The Infrastructure Gap: Why Old Tools Fail

Traditional wealth infrastructure built on proximity, physical documents, and periodic in-person reviews was never designed for this level of mobility. Documents were stored in filing cabinets at private banks. Communication happened through local channels. Advisors and clients met face to face, often over coffee or during scheduled quarterly reviews.

Fast forward to today’s reality: an advisor in Dubai must understand a custody arrangement that lives in Switzerland, while a family office in London needs real-time access to property holdings in the U.S. Documents sit in encrypted vaults half a world away. Email threads stretch across time zones. Secure communication becomes fragmented and untrustworthy.The tools of yesterday simply do not scale to meet the demands of a mobile, interconnected, globally distributed wealth ecosystem.

Technology as the Connective Tissue of Global Portfolios

What this environment urgently needs are systems built for global visibility, real-time analysis, and secure interoperability. In essence, technology must act as the connective tissue that makes disparate pieces of wealth function as a single coherent entity.

The right platform does more than aggregate data, it provides:

- Real-time visibility across all holdings regardless of custody location

- Secure, auditable communications across jurisdictions and time zones

- Aggregated analytics that reconcile multi-currency portfolios and asset classes

- Automated alerts for meaningful deviations, risks, or strategic opportunities

These attributes transform wealth from a collection of fragmented accounts into a centralized strategic asset, even when that wealth remains physically distributed across the globe.

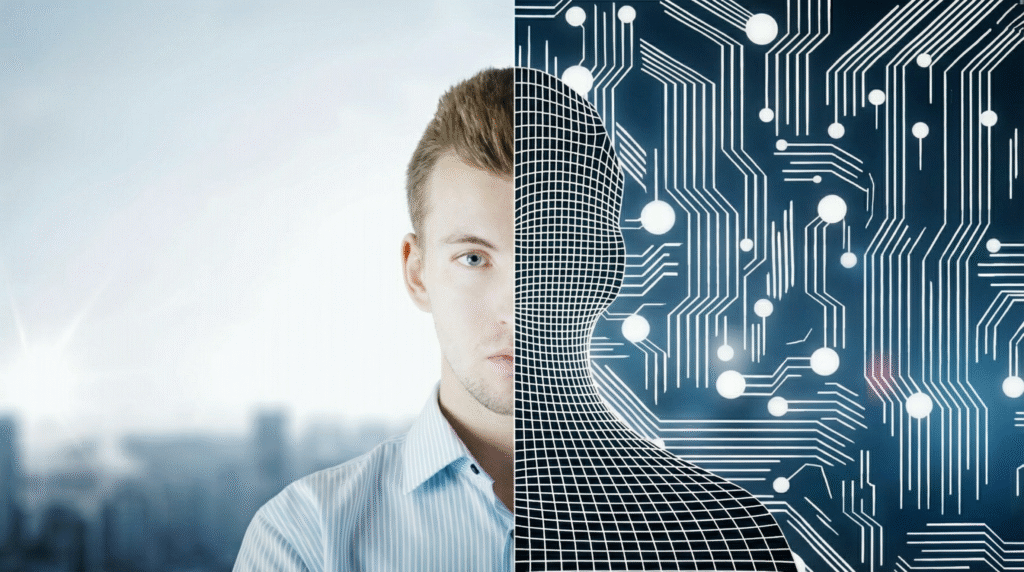

Technology Does Not Replace Advisors — It Elevates Them

Importantly, this is not a story about replacing human advisors with machines. The most effective wealth managers and family offices leverage technology to elevate human expertise, not substitute it.

Insightful, responsive service remains the touchstone of trust for UHNWIs. Whether it’s reconciling a complex cross-border tax position or making strategic decisions about asset allocation, technology should empower advisors to focus on judgment and strategy, rather than data tabulation and administrative overhead.

The most successful teams combine:

- Swiss-grade security and compliance

- Clear, intuitive interfaces

- Highly responsive human support

- Strategic advisory insights informed by technology

And importantly, they deliver clarity not just data to clients whose time and attention are among their most valuable assets.

The New Essential Infrastructure for Mobile Wealth

For the modern UHNWI, the future of wealth management is not a place, it’s a platform. One that brings cohesion to dispersed assets, aligns advisors from different corners of the world, and delivers strategic insights wherever the principal may reside.As the Great Wealth Migration continues and UHNWIs increasingly traverse borders while their assets remain scattered, the demand for purpose-built technological infrastructure will only grow. Those who embrace it will find greater control, reduced complexity, and ultimately better strategic clarity in a world where movement is the new norm.